Is Nvidia facing the early stages of a Strategic Inflection Point?

Author: Fadil Karim

Contact: insights@denarianalytics.com

20th July 2023

What is a Strategic Inflection Point

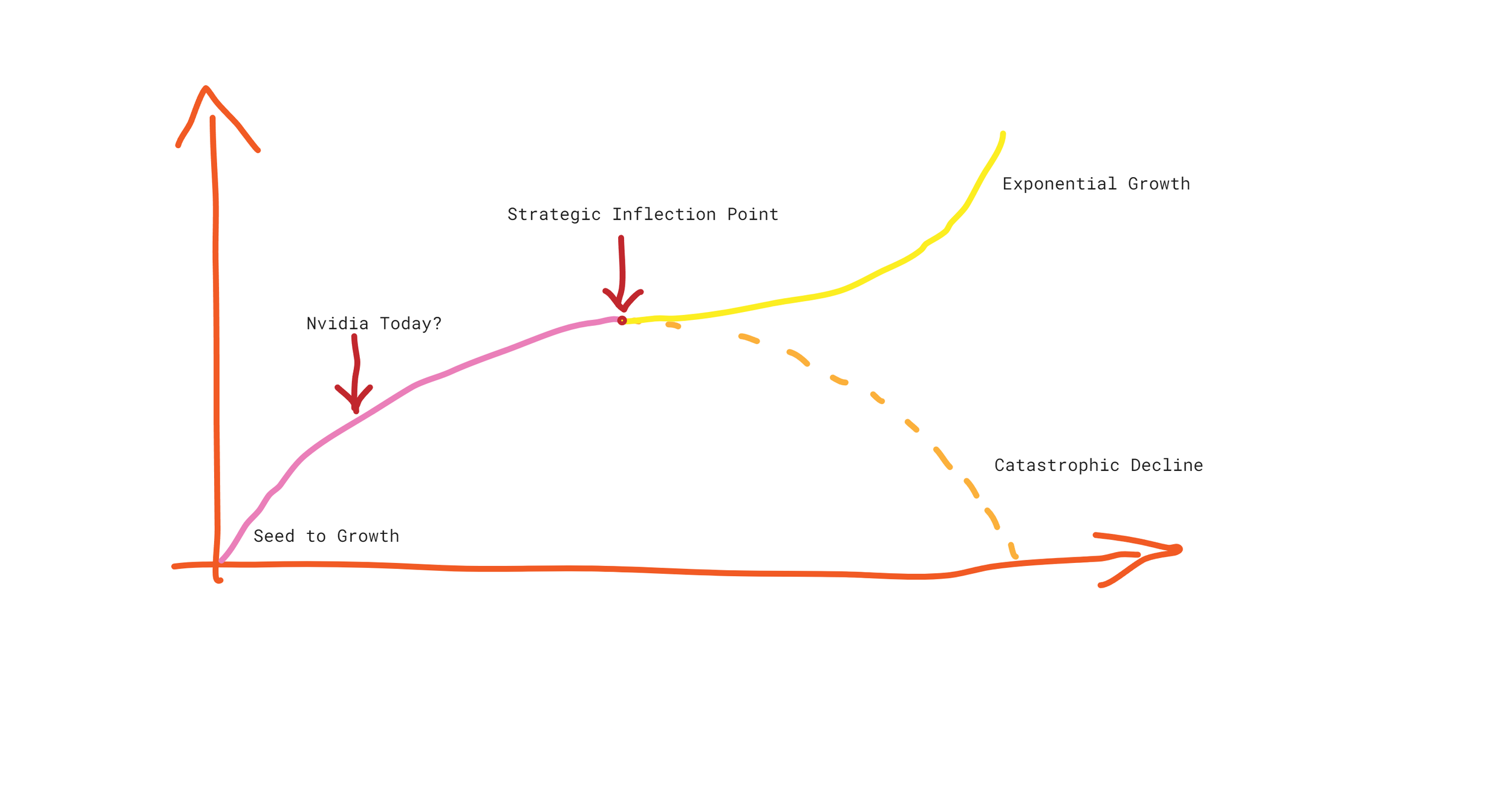

A strategic inflection point occurs when the growth curve of a business hits a plateau as a result of the old strategic picture dissolving before giving way to the new, allowing the business to either ascend to new heights or decline to devastating lows (Figure 1). The signs of a strategic inflection point occur long before it emerges and companies need to stay paranoid to spot them long before they emerge so that they are prepared to act when needed. This term was coined by Andrew S. Grove in his book, “Only the Paranoid Survive”, to illustrate the problem that Intel faced during his tenure as CEO of the company when their main product was memory chips. In the mid-80’s, Japanese rivals created memory chips that were better and cheaper than Intel’s, so Grove needed to act to secure the company’s survival by maneuvering through this strategic inflection point. Grove decided to take a risk by moving Intel away from memory chips manufacturing and made it a pioneer of the new microprocessor manufacturing industry, ascending it to new heights. The success of Intel’s microprocessors caused a strategic inflection point to occur in the computer industry, forcing companies to adapt accordingly. Intel’s microprocessor technology caused a strategic inflection point to occur because, at that time, computer manufacturers would be responsible for building every element of a computer. This meant hardware such as the motherboard and chips as well as software such as the operating system and applications, and they would also handle sales and distribution themselves. This vertical map of the computer industry was the norm, but it was also an inefficient way of selling computers. Intel’s microprocessor was so good that computer multiple computer companies opted to incorporate it into their hardware, leading new players to the computer industry to wonder why they couldn’t purchase all hardware components separately, install a universal operating system and software, and sell the finished product. These questions led to actions by new companies like Dell and Microsoft which thrived in this new environment and companies like IBM that refused to accept this changing of the strategic map of the industry lost significant market share and still have never fully recovered, opting to move into alternative computing industries (Figure 2).

Figure 1. The Strategic Inflection Point

Figure 2. Transformation of the Computer Industry

Nvidia’s Current AI Success

Recently Nvidia, a Graphical Processing Unit (GPU), manufacturer, has more than tripled in stock market value since January of 2023, moving from $140 per share to $465 as of today[i] and it even temporarily reached a trillion-dollar valuation earlier this year[ii]. GPUs, much like microprocessors, are a hardware component for computers. GPUs process heavy data and are required for high-end gaming, 3D design, and training AI models. The recent AI boom has been pivotal in the surge of Nvidia GPU sales. Additionally, Nvidia’s products and technology are far ahead of their nearest competitor, and this can be seen in that that it owns 84% of the GPU market share, with AMD, its closest competitor, only holding 12% as of Q1 2023[iii] (Figure 3). Historically, Nvidia’s clients have been retail customers who purchase the GPUs for directly gaming or professional software, or indirectly, by purchasing computers that contain their GPUs. In recent years, with the expansion cloud computing services such as iCloud and AWS, Nvidia acquired an additional revenue segment to its client list in the form of big tech corporate clients including Amazon (AWS), Microsoft, and Google, who purchase GPUs to fill their cloud data centres with graphical processing power so that their clients have the required capacity to build and run AI services. These two revenue segments have been named as Graphics, consisting of the former segment, gamers and professionals, and Compute & Networking, consisting of the latter segment corporate clients. As of January 2023, Nvidia’s Graphics segment is worth $11.9B, while its Compute & Networking revenue segment is worth $15B, meaning that its corporate clients make up more than half of its existing revenue (Figure 4)[iv].

Figure 3. Nvidia Market Share

Figure 4. Nvidia’s Revenue Segment

Nvidia’s Future

Nvidia’s Compute & Networking revenue segment may be at risk. This segment buys Nvidia GPUs for their cloud data centres. A cloud data centre is effectively a giant computer containing thousands of computer components all connected to a network and the building itself acts as the computer’s case. Clients from around the world connect to the data centre via the internet and create individual computer instances by choosing which components and operating systems they want and pay rent by the minute to run these instances. AI startups like OpenAI (ChatGPT) require hundreds to thousands of these instances and can’t afford to purchase and maintain their own use these cloud services to build, train, and host their AI models with a specific need for GPUs that can compute AI functions. Considering that Nvidia currently builds the best GPUs for AI, the recent surge in the success of AI startups has drastically increased sales of its GPUs specifically and with further expansion over the horizon, that increase trend will probably continue. But what is over the horizon isn’t all positive for Nvidia. Amazon[v] and Google[vi] have all announced plans to build their own AI-capable GPUs and there are reports that Microsoft is helping AMD to expand into AI chips in return for help developing Microsoft’s own AI GPU[vii]. Additionally, Apple, once a corporate purchaser of Nvidia GPUs, has successfully developed and implemented its own integrated GPU system into all of its Mac products[viii]. The goal of these tech giants, in developing AI-capable GPUs, is to reduce their dependence on Nvidia and decrease costs.

Why might this be a Strategic Inflection Point?

According to Grove, Strategic Inflection Points are difficult to detect and there are many scenarios that may look like one but end up being false alarms and over committing to one of these will lead to a waste of resources. Nvidia’s current situation definitely looks like a strategic inflection point but we must assess weight of the threat by analyzing the evidence. Nvidia’s corporate clients provide them with their biggest revenue segment and are responsible for their recent and sudden growth, but the biggest of these clients, Amazon, Microsoft and Google are now building their own GPU technology. These corporations have huge funds and a wealth of experience, and huge data centres with large client bases to of their own to test and incentivize their own GPU technology in the field. Furthermore, another big tech company, Apple, has successfully developed and fully implemented its own GPU technology in its products. The evidence so far shows that there is a significant risk that Nvidia may lose over half of its revenue in years to come as it may lose its big tech clients. Additionally, the GPUs that these tech giants develop, likely available for purchase, will rival Nvidia’s product line. This means that Nvidia, while currently way ahead of all competitors, may be at risk of losing its strong position as market leader in a few years. Another noteworthy piece of evidence that Nvidia is face the early stages of a strategic inflection point is that the horizontal map of the cloud computing industry is shifting from what it is now, a duplicate of the horizontal computer industry, to a horizontal-vertical hybrid mapping of the industry with tech giants developing, manufacturing and using their own components (Figure 5).

Figure 5. Potential Transformation of the Cloud Computing Industry

Conclusion

One thing is certain, Nvidia are not currently experiencing a strategic inflection point and are experiencing good times with more good times to come however, according to Grove, it is in good times that inflection points develop slowly, and it is in these times that C-suite executives must stay paranoid for the sake of their survival. Based on the likely changing of the map of the cloud services industry in the near future, It is likely that Nvidia will be facing a strategic inflection point in a few years if their clients are successful in creating their own GPUs. Intel faced a similar problem in the mid-80s when their Japanese rivals developed cheaper and better memory chips. Intel solved the problem by leaving the memory chip industry and embracing microprocessors, one of the technologies their Research and Development team pioneered. This technology also perfectly aligned to the new computer industry map. Nvidia are currently purchasing their own data centres and providing cloud services to rival their clients and are investing in Research & Development but there is not enough publicly available information to assess which course of action is best for them going forward. What can be assessed is the fact that they are likely going to experience a strategic inflection point (Figure 6) in the near future and need to prepare for it now as they are in a hostile landscape but may be blinded their current good times. The late Andrew S. Grove himself said, “I think of this hostile landscape through which you and your company must struggle – or else perish – as the valley of death. It is an inevitable part of every strategic inflection point. You can’t avoid it, nor can you make it less perilous, but you can do a better job of dealing with it.”

Figure 6 – Nvidia Today?

References

[ii] https://www.reuters.com/technology/nvidia-sets-eye-1-trillion-market-value-2023-05-30/

[iv] https://fourweekmba.com/nvidia-revenue-by-segment/

[v] https://www.fool.com/investing/2023/04/20/amazon-ceo-on-ml-chips-is-nvidia-in-trouble/

[vi] https://www.nextplatform.com/2022/05/11/google-stands-up-exascale-tpuv4-pods-on-the-cloud/

[vii] https://www.theverge.com/2023/5/5/23712242/microsoft-amd-ai-processor-chip-nvidia-gpu-athena-mi300